Last week we told you it was coming. Today, I’m happy to tell you it’s here. Futurum Signal is live. And while the word “live” is thrown around a lot in our industry, in this case it’s not just marketing fluff. Futurum Signal isn’t another white paper dressed up as research, or a static quadrant that looks outdated the moment it’s published. It’s real-time, AI-powered market intelligence that adapts as the market moves—and in today’s noisy, agentic-AI-fueled landscape, that’s exactly what we need.

When we first announced Futurum Signal last week, the response across our Techstrong properties was immediate. We ran stories on DevOps.com, Digital CxO, Security Boulevard, Techstrong.ai, and right here on Techstrong.IT. Each community saw the value of Futurum Signal through their own lens: DevOps and platform engineering leaders saw a way to finally get clarity in the tooling wars, CXOs saw a dashboard for decision-making in an era of transformation, and security defenders saw a lifeline in the fight against evolving threats. In short, the market was intrigued.

What’s Inside the Futurum Signal

So let’s dig into what Futurum Signal actually is and what it shows you. At its core, Signal is not just a data stream—it’s a framework for making sense of markets in motion.

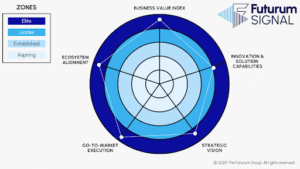

Take the vendor Radar. Unlike the static quadrants we’ve all grown used to, the radar captures multiple dimensions of vendor performance at once:

- Business Value Index – what kind of ROI customers are really seeing

- Innovation & Solution Capabilities – whether the offering keeps pace with tech evolution

- Strategic Vision – how well leadership is steering for the future

- Go-to-Market Execution – the reality check on promises vs. delivery

- Ecosystem Alignment – how well a vendor plugs into the broader partner/customer ecosystem

Vendors are then placed into Signal Comparative Zones—Aspiring, Established, Leader, or Elite. It’s a more nuanced view than just “top right vs. bottom left.” Some vendors excel in innovation but lag in execution. Others are great at ecosystem alignment but weaker on vision. Futurum Signal makes those strengths and gaps visible at a glance.

The Futurum Signal Radar shows how vendors perform across five dimensions: Business Value Index, Innovation & Solution Capabilities, Strategic Vision, Go-to-Market Execution, and Ecosystem Alignment. Vendors are placed into zones—Aspiring, Established, Leader, or Elite—for a more nuanced market view than a simple “top right quadrant.”

Then there’s the Vendor Comparative Zones, which groups vendors visually into concentric rings—again showing who’s breaking out, who’s holding steady, and who’s still aspiring. It’s quick, intuitive, and makes relative positioning clear.

The Vendor Comparative Zones provide a quick snapshot of relative vendor positioning. Concentric rings illustrate whether a vendor is still Aspiring, has become Established, is emerging as a Leader, or is breaking into the Elite zone.

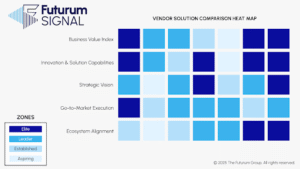

Finally, the Heat Map lets you compare vendors across the five key metrics side-by-side. It’s like looking at a data-driven fingerprint of each company, instantly showing patterns across a sector. You can see who consistently scores “Elite” across categories, and who is uneven, strong in some areas but weaker in others.

The Heat Map is like a fingerprint of each vendor, showing relative strengths and weaknesses across the five metrics. Side-by-side comparisons make it easy to see who is consistently strong across categories and who is uneven.

And this is just the start. Futurum Signal offers a dashboard where users can slice markets by solution area, drill down into vendor-specific trends, and overlay customer sentiment pulled from millions of G2 reviews. Instead of a once-a-year analyst report, you’re looking at a living system that surfaces fresh insights near continuously.

Oh, and did I mention the “Futurum Spotlight”? Recognizing that not all vendors are going to be mature enough to make their mark in the same way large established players do, Futurum Signal will also offer a list of Spotlight companies, which will do just that: shine a spotlight on vendors that the data shows are up-and-coming and worthy of your attention.

Today’s Launch: First Solution Area

With today’s launch, the first solution area—Data Intelligence Platforms—is now live. This is the perfect starting point: data is the lifeblood of digital transformation, AI, and every modern enterprise initiative. In the coming weeks, additional solution areas will come online, including Security Operations Platforms, Software Engineering Platforms, Agentic AI Platforms, AI Cloud Platforms, Sales/Service/Marketing Platforms, and Cloud Marketplace Platforms. Will the roadmap evolve? Absolutely. Like any ambitious new service, Signal will adapt to both user demand and the reality of AI innovation. But make no mistake—the foundation is set.

Market Reactions & Feedback

Over the past week, since making the announcement, I’ve had conversations with vendors, customers, and analysts across the ecosystem. The feedback has been overwhelmingly positive, with a few consistent questions that keep coming up. Let me address them here, as you probably are wondering as well.

Q1: How do you collect the data?

This is where Signal breaks the mold. The data comes from three primary sources, what I call our “three-legged stool.” First, G2. Our exclusive partnership with them provides unmatched scale— millions of peer reviews and user insights dwarf the traditional survey models, where a few hundred respondents are often considered “statistically significant.” Second, we use agentic AI to continuously harvest and verify publicly available data—websites, reports, social signals. Of course, “drinking from the firehose” is useless unless you can clean, correlate, and verify. That’s where our AI-human-in-the-loop system comes in. Finally, the Futurum analyst team sits on top of this stack, adding context, nuance, and validation. Taken together, it’s a sturdier foundation than any single source could provide.

Q2: How do people access the data?

There are several paths. If you’re a Futurum Research subscriber, you get full access to Signal in your chosen solution area, updated near continuously. Vendors will also license Signal data for their own uses, which means many end users will likely encounter Signal insights as part of their vendor relationships. And, for the broader community, Futurum will publish snapshots and executive summaries—not real-time, but enough to provide useful directional insights. As with any new service, the models may shift, but the goal is to keep the market well-informed.

Q3: Can we influence the findings?

This isn’t your grandfather’s analyst report, where a vendor lunch and a well-placed sponsorship might perhaps magically move you into favor. Futurum Signal doesn’t play that game. The data is the data—coming from millions of G2 user reviews, AI-verified public sources, and Futurum’s analyst research. You can brief the analysts, of course (and you don’t need to be a paying Futurum client to do so), but you can’t game the system. Pandering won’t push you to the “Elitet” here. If you want to influence the findings, the only way is to actually influence the market.

Final Thoughts

That last point may sting for some, but it’s also the most liberating. The whole industry has lived for too long under the tyranny of static analyst charts and reports, where perception sometimes mattered more than reality. Futurum Signal changes that. It levels the playing field, making market leadership less about who you know and more about what you deliver.

Now, let me be clear: Futurum Signal is new. It will learn, change, and evolve, just as the markets it covers evolve. As AI improves, so will Signal. As customer needs shift, so will Signal. This is not a finished monument; it’s a living system. But there comes a point where you can’t keep tinkering in the lab—you have to let your creation out into the world to fly.

That moment is today. Futurum Signal flies.