When I saw the headline from Ray Wang’s new Futurum Intelligence report—Data Center Semiconductor Market to Reach $500 Billion by 2029—my first reaction was: yeah, that tracks. And maybe even underestimates it.

We’ve been watching the surge in AI demand accelerate like a SpaceX launch, and semiconductors—especially those optimized for inference, training, networking, and storage—are the literal rocket fuel. This report doesn’t just confirm the trend. It gives us the receipt.

A Hockey Stick on Fire

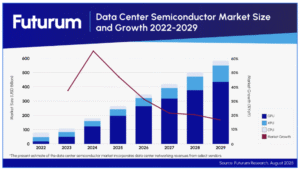

According to the report, the global data center semiconductor market stood at $145 billion in 2023. That figure is projected to balloon to more than $500 billion by 2029, representing a 4.1x increase in just six years. The primary driver? AI infrastructure.

Here’s the kicker, and I quote directly from the press release:

“The explosion of interest and investment in AI is shifting the entire center of gravity for the global technology stack—and nowhere is this more evident than in the data center semiconductor space,” said Ray Wang, research director for semiconductors, supply chain, and emerging tech at the Futurum Group.

Ray’s right. This isn’t just a chip story. This is a redrawing of the infrastructure map.

Semiconductors: The Spine of AI Infrastructure

The Futurum report breaks down the surge across several key domains:

- Compute (CPUs, GPUs, TPUs, and increasingly, AI accelerators like the H100, MI300X, and Gaudi2)

- Memory & Storage (high-bandwidth memory, SSDs with lower latency for AI caching)

- Networking (fabrics, interconnects, and high-throughput I/O solutions)

- Power Management (as hyperscalers attempt to contain the thermal footprint of next-gen AI workloads)

The report’s forecast includes data center-specific silicon—not just general-purpose chips. These are components purpose-built for AI workloads: inferencing, training, model deployment, and edge-to-core orchestration.

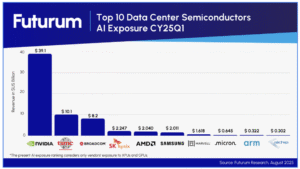

One of the most striking visuals in the press release is a bar chart mapping the semiconductor categories most likely to experience hypergrowth. Not surprisingly, AI accelerators and smart NICs top the list.

And don’t overlook the Q1 data: spending in Q1 alone jumped nearly 22% year-over-year, with NVIDIA, AMD, and Intel all showing strong AI-specific revenue gains. Even the often-overlooked memory and power subsystems are riding the wave.

All Roads Lead Through AI

The $500 billion projection is predicated on a continued AI build-out across industries, geographies, and modalities. But this is where the story turns from inevitability to fragility.

If the AI market cools off, that $500 billion number starts to look like vaporware. AI’s gravity is powerful—but also volatile. Right now, it feels like the entire semiconductor supply chain has bet the farm on persistent AI demand.

The good news? That demand isn’t just theoretical.

Follow the Money: $1.5 Trillion and Counting

According to multiple industry trackers, we’re now at $1.5 trillion in pledged investment for AI data centers, “AI factories,” and hyperscaler AI zones. Microsoft, Google, Meta, AWS, Oracle, and Chinese hyperscalers like Tencent and Alibaba are all laying down concrete and copper.

But let’s be honest: pledged money is not the same as shovels in the ground.

And it certainly isn’t the same as operational infrastructure with real workloads generating revenue.

Many of these announcements are front-loaded with hype and back-loaded with execution risk. Permitting, power availability, geopolitical restrictions, and supply chain complexity all threaten to turn pledges into paper tigers.

Still, with NVIDIA’s recent $13.5 billion data center revenue in a single quarter, and Blackwell, Gaudi3, and other next-gen architectures already booked into 2026, this market seems to have enough velocity to break escape orbit.

What Happens Next?

I keep coming back to the macro question: What happens when a $500 billion hardware segment becomes the new baseline for infrastructure?

We’ve already seen the transformation in how software is being built, deployed, and run. The new stack is AI-native from the ground up. That includes AI DevOps, AI observability, AI-native security, and yes—even AI-native platforms built on silicon-aware orchestration layers.

We’re not just plugging AI into old systems. We’re building entirely new factories for intelligence.

So yeah, the number might be $500 billion by 2029. Or it might be $600B, or $800B. But it only happens if this AI wave keeps rising—and if the world keeps demanding more inference, more training, and more intelligence, faster and cheaper than before.

That’s a big “if.” But so far, the chips are falling exactly where you’d expect.

Shimmy Says

Here at Techstrong, we’ve been tracking this market for a while. We’ve covered everything from NVIDIA’s Blackwell and AMD’s MI300X to Oracle-Google Cloud’s AI infrastructure play. And now we’re seeing what happens when all those threads converge into a singular trendline.

Hockey stick growth is exhilarating—but it’s also exhausting. As an industry, we have to build for resilience, not just scale. And as we move deeper into the age of AI-first everything, the semiconductor supply chain becomes both our sword and our shield.

So yes, it’s a $500 billion story. But more importantly, it’s a story about where power is shifting—and who holds it.

Stay tuned. This ride is just getting started.