With tariffs announced by President Donald Trump set to reach restrictive levels not seen since the 1930s, the tech sector now navigates a future filled with uncertainty from a dizzying array of variables.

Among those, the tariffs, ranging from 34% on Chinese imports, 20% on European goods and 10% on overall imports, may or may not launch a global trade war. On Monday, Trump threatened China with an additional 50% tariff if they didn’t rescind their retaliatory tariffs — he gave the Chinese a mere two days to reverse course.

European leaders are also discussing retaliatory tariffs that push the trade conflict to a new level. Tariffs may now include tech services in addition to tariffs on hard goods. Sophie Primas, a spokesperson for the French government, said that France is “ready for this trade war” and is prepping a response, “probably” by the end of April. “The second response will cover all products, and I want to stress this — services will be included,” she said, listing digital services provided by Google, Amazon, Facebook, Apple and Microsoft.

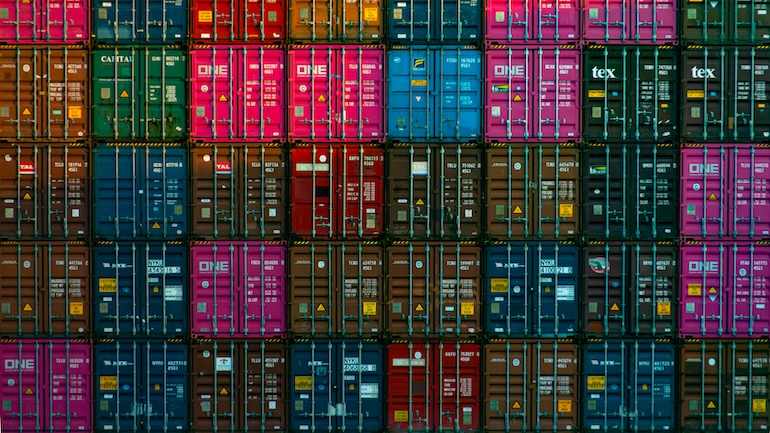

Amid these escalating trade war threats, tech executives, both enterprise customers with big budgets and those that lead tech vendors, are attempting to plan for the future. Complicating this guessing game are tech supply chains that are famously complex, often combining multi-country production and assembly, and can stretch over a lengthy time period, anywhere from 8-12 weeks to more than two years.

Furthermore, these high-stake budget decisions must be made in light of President Trump’s well-established penchant for unpredictability—so any tariffs could change next week, next month or at any other moment.

“We all can see that this is a fluid tariff environment, and it is difficult to tell if they will stick, or rather, be used as a negotiating weapon,” said Alex Smith, VP, Channels Research and Practice Operations, The Futurum Group, who wrote about this in an article recently. “What we can say is that every business will be impacted. Technology hardware companies have been working hard to diversify their supply chains since the pandemic and the last trade war, but many of those actions will prove redundant given the scale of this latest tariff round. Meanwhile, services companies that might think they are immune to these orders may find that retaliation actions from other countries target the services sectors where the U.S. is more likely to have a trade surplus. No company will be fully immune from this.”

To oversimplify a chaotic situation, there appears to be two main contexts for how tariffs will reshape the tech sector: The global macro view, and a more detailed IT product sector view.

At the macro level, tariffs will necessarily boost prices. But who will absorb the price increases, and to what extent? Will the “Magnificent Seven,” which are envied for their fat margins — typically double or higher than other S&P 500 companies — opt to eat the tariff costs and so “contain” the impact on the larger community of tech buyers? Or, facing a falling market where margins are already squeezed, will these giants pass the majority of costs along to buyers? Those are trillion-dollar questions.

On a more detailed level, the hardware that supports IT infrastructure — storage gear, servers and networking equipment — could see big price boosts as overseas manufacturers deal with hefty tariffs. Tablets and laptops could suffer double-digit cost increases. Approximately 80% of all Apple devices and 90% of iPhones are made in China.

For enterprise personal computing gear, the tariffs are poised to have major impact: Enterprise management will be hesitant to approve additional expenses for new initiatives, so innovative projects may be postponed or cancelled.

Tariff-related costs for cloud computing and other tech services are less clear. Software and SaaS are not subject to tariffs, so these sectors may escape relatively unscathed. Then again, these services are built upon a foundation of tech hardware, so they must be facing some cost increases. (Vendors of software and/or services will need to include increased costs in their own pricing assumptions.)

For tech services, as noted, some European leaders are considering tariffs but this hasn’t happened yet. But if it did, the effect could be huge: The U.S. has a services trade surplus of more than $100 billion with the EU (This includes business and financial services along with tech.)

At the center of today’s tech growth is artificial intelligence (AI), and at the center of AI is the semiconductor, which has so far been exempt from U.S. tariffs. But this is widely expected to change, based on statements by Trump administration officials. And the picture is even more unclear because the supply chain for chips is truly global.

NVIDIA’s supply chain depends on imports from China and Taiwan, which face steep tariffs. In contrast, Stacy Rasgon, an analyst with Bernstein Research, said that AI servers made in Mexico with NVIDIA chips may be exempt from tariffs. This example illustrates that the tariff picture affecting tech is so filled with exceptions that it’s impossible to fully predict.

Even though chips are currently exempt, leading chip maker TSMC is facing a 32% tariff based on its Taiwanese location; top semi equipment maker ASML, based in the Netherlands, must contend with the 20% tariff on EU products. Since ASML builds so many of the high-end lithography tools needed to fabricate chips, this tariff could lead to an overall price increase in the chip market.

Meanwhile, in a dire assessment, market researcher IDC, warns the levies set to be implemented April 9 threaten to cut the rate of growth of worldwide IT spending in half over the next six months. The tariffs, IDC says, will “have an inflationary impact” on technology prices and disrupt supply chains. IDC predicts global IT spending to now grow 5% rather than 10% as previously forecast.

IT services spending is particularly vulnerable to the slackening of new contract agreements, which will be driven by the broader economic slowdown in the next six to 12 months, IDC says. Coupled with economic headwinds such as U.S. government spending cutbacks, the outlook is much weaker for short-term investment in new technology projects for AI infrastructure and data centers. This could conceivably impact such projects as Stargate, a $500 billion infrastructure initiative led by OpenAI, SoftBank and Oracle Corp. and backed by the White House.

Analysts at the research firm say it was preparing an updated scenario that accounts for a wider trade conflict on wildly unpredictable, fluid events. Triggering an escalation of retaliatory measures, the tariffs could precipitate a global recession and send IT spending into a spiral, potentially leading to the worst market performance since the 2008 financial crisis, according to IDC.

“Our March 31 forecast of 10% growth for global IT spending will be reduced significantly in April, based on the tariff announcements of April 2,” IDC said in a blog post. “The situation remains extremely fluid, and subject to new announcements or changes, but a weakening economy will lead to IT spending cuts and delays in the next six months. We will move closer to the previous downside of 5% growth, which reflects a rapid, negative impact on hardware and IT services spending.”

Slower growth, IDC added, is the “new reality,” although it hastened to add that underlying demand for IT was still “high” and the likelihood of a decline in overall IT spend was low.

Businesses will first look to cut spending on devices and on-premise infrastructure, seeking rapid cost benefits to protect the bottom line. Any job cuts will have a direct impact on some types of IT spending. Service providers will try to maintain their aggressive investment in deployments of AI infrastructure, IDC added.

“If these tariffs went into place at current form, overall tech earnings would come down 15% at least, the supply chain will be a Rubik’s Cube rivaling Covid days, and the economy would go into a recession/stagflation,” Wedbush Securities analyst Dan Ives warned in a note last week. “We assume tariff negotiations start now otherwise dark days are ahead for tech…and U.S. consumers pay the price for this.”

Consumers, meanwhile, aren’t waiting. Bloomberg reports a rush in “panic” sales at Apple Stores before tariffs jack up prices of iPhones, iPads and Macintosh computers.