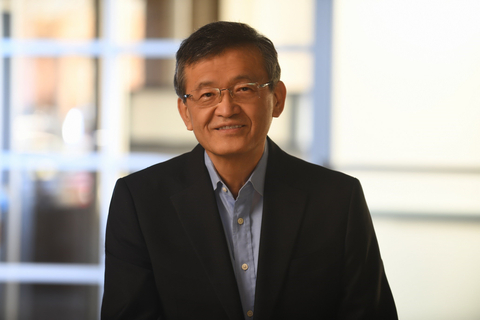

When new Intel Corp. CEO Lip-Bu Tan makes his first public comments Monday since being appointed earlier this month, he may well face an Indiana Jones moment.

Tan could swoop in as the action hero, deftly perform off some hair-raising moves, and rescue an American institution.

The parts are there to pull it off: From turbocharging the company’s fledgling foundry business to making more job cuts on top of 15,000 already announced.

If anyone can pull off a turnaround at Intel, it might be Tan. The former CEO of semiconductor software maker Cadence Design Systems is a veteran of about a dozen boards including Intel. Tan left Intel’s board last year, reportedly after disagreement with former CEO Pat Gelsinger over the company’s bloated workforce, slow, bureaucratic and risk-averse culture and lagging artificial intelligence (AI) strategy.

“He’s quite good at structuring business models, as he did at Cadence,” says Blaize CEO Dinakar Munagala, who worked on Intel’s graphics chips team for a dozen years and knows Tan personally. “Lip-Bu is one of the few visionary semiconductor investors.”

Tan, who is expected to simplify Intel’s inner workings and add a jolt to its AI chips innovation, shared a simple message with employees in a letter on March 12. “Together, we will work hard to restore Intel’s position as a world-class products company, establish ourselves as a world-class foundry and delight our customers like never before,” he wrote.

Or things could unravel further, as it did under Gelsinger and his predecessors, forcing the 57-year-old company to be sold off, piece by piece. Indeed, in some corners of Silicon Valley, Tan’s task is quietly referred to as Mission: Impossible.

Tan takes over a company whose falling stock price and financial losses amid brutal competition from NVIDIA Corp., AMD Inc. and Arm have made it a takeover target in recent months. Indeed, Wall Street analysts and investors believe Intel, the only American leading-edge chip manufacturer, would be better off splitting up and selling its struggling manufacturing business — something Tan does not intend to do, according to a Reuters report. Instead, Tan intends to play catch by reviving Intel’s flagging AI chip efforts.

For more than a decade, Intel has misfired entering what is now a booming AI chip market. Earlier this year, it ditched a high-end AI GPU called Falcon Shores. In 2017, despite the hiring of Raja Koduri, AMD’s graphics chip engineer, to internally develop a GPU, the project failed. The company also scrapped a multiyear project, Larrabee, in 2009 to develop a standalone GPU like NVIDIA’s.

“Intel has been very quiet since Gelsinger’s exit (earlier this month), and the company urgently needs to communicate a new product strategy with the market. I am certain Lip-Bu Tan will make a clear case for Intel (the product company) going forward,” Stephen Foskett, president of Tech Field Day, The Futurum Group, said in an email. “I will also be watching closely for any confirmation of the supposed preference by Lip-Bu Tan to split Intel at least partially from the foundry business. I will also be listening carefully for any hint of partners that might join Intel in funding this spin-off, especially names like TSMC (who have been named repeatedly as potential partners), AMD (who spun off their own GlobalFoundries business in 2009), NVIDIA (who would love a U.S. manufacturing partner), Apple (same), and Broadcom.”

The structure of Intel’s product business, which designs chips, can’t easily be outsourced to rival manufacturers because its semiconductors are specifically made in accordance with its own internal manufacturing processes.

At the same time, Intel’s $7.9 billion in funding from the CHIPS and Science Act (2022) requires it to retain majority ownership of its foundry. Its foundry strategy, which includes plans for a new advanced chip manufacturing process called 18A this year and deals with Amazon.com Inc. and Microsoft Corp., lost $13.4 billion on revenue of $17.5 billion last year. Adding to the angst, President Trump’s Administration has threatened to effectively kill the CHIPS Act, and Intel recently delayed the opening of a $100 billion chip manufacturing facility in Ohio until 2030, at least five years after it was supposed to start production.

“I think the beginning of the decline dates to 2011 when Apple was in the position to choose between Intel and TSMC foundry and ultimately chose TSMC,” recalls consultant Wayne Johnson, a former executive at semiconductor materials supplier IQE. “The respective foundries have diverged since then. Even at that early date in iPhone history, it could be seen as a watershed moment. Intel had, in my view, a skewed world view that microprocessors (equaled) Intel. Fast forward 15 years and it’s easy to say that Intel isn’t even in second place.”

Still, many in tech aren’t ready to give up on Intel. In fact, they’re actively pulling for the company and its legendary legacy.

“This is a hard time to look clean and pretty. The marketplace waters are so choppy, with fears of a recession, the threats of tariffs, and supply chain disruption,” Barry Broome, president and CEO of the Greater Sacramento Economic Council, said in an interview. “AI is like a bolt of lightning from the sky. The good news about Intel is that it is a company with a great brand, great ideas, and it has a chance to reimagine itself. I believe it will come out of this.”

“I think this leader can turn things around,” said Broome, noting that Intel’s R&D center is in nearby Folsom, Calif.

No CEO has seen a reclamation project of quite this scope since a parade of CEOs, ending in Marissa Mayer, tried to revive Yahoo. Of course, several tech icons have been near death’s door before — Apple Inc. in the late 1990s, comes immediately to mind — and didn’t just survive but thrive.

In the case of Lip-Bun Tan, it’s a chance to be a hero or zero.